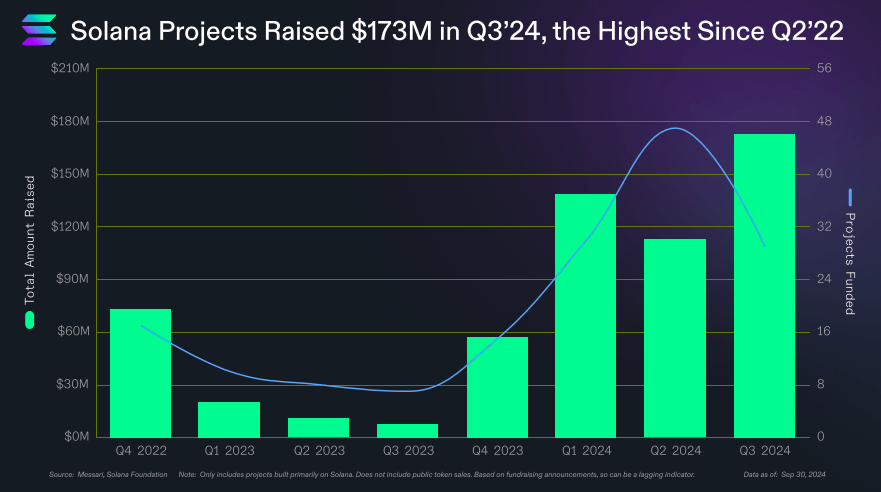

According to the ‘State of Solana: Breakpoint Edition’ report, 29 projects on the Solana blockchain raised $173 million this quarter, the highest amount since 2022, with $103 million raised in September alone, marking the strongest month since June 2022.

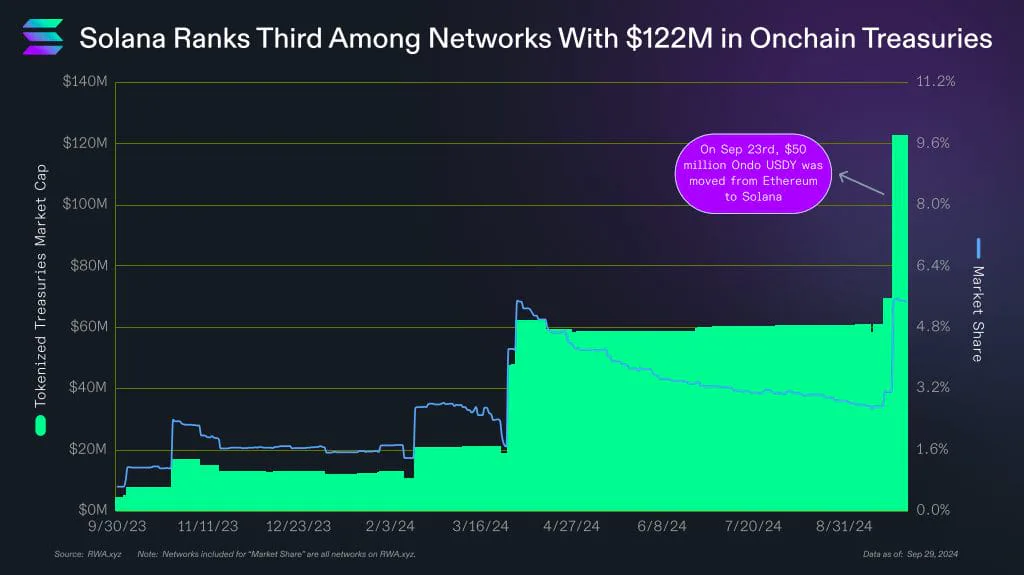

Solana’s Crypto Treasury Market Expands

The value of Solana’s crypto treasury market doubled to $123 million within 30 days, driven by a $50 million USDC inflow from Ethereum on September 23.

Although Solana trails behind Ethereum ($1.6 billion) and Stellar ($422 million), recent developments indicate significant potential.

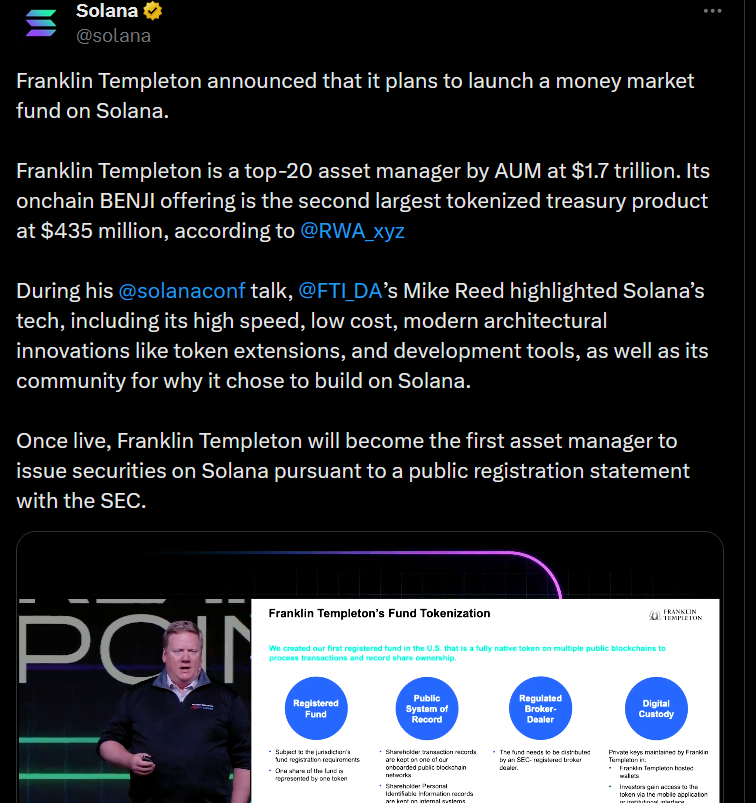

Major firms such as Franklin Templeton (managing $1.7 trillion in assets) and BlackRock have launched investment funds on Solana.

Franklin Templeton plans to launch a money market fund on Solana, while BlackRock has partnered with Securitize to launch the BUILD crypto fund, which currently manages over $522 million.

Solana’s On-Chain Activity Declines

Despite increasing interest from institutional investors, Solana’s on-chain activity has decreased over the past six months.

Monthly transaction fees dropped by 66% from their peak in March, although they remain 1,900% higher than the previous year.

Over the past six months, Solana generated $260 million in fees, ranking third after Ethereum and TRON.

As of October 7, Solana’s total value locked (TVL) reached $5.6 billion. SOL, Solana’s native token, is currently priced at $148, up over 15% in the last 30 days.

Will Solana’s ecosystem continue to grow, and what will happen to the SOL token in the future? Stay tuned with Bnb Faucets for more updates!

FMIA fBbscp FTE kEwFDijs

It’s fascinating how much emphasis platforms are putting on service now, not just games. Seeing PH987 prioritize user experience & feedback-like they detail-is a smart move for long-term player engagement. Definitely a shift!

Interesting article! Bankroll management is key, and seeing platforms like Kunwin cater to the Vietnamese market with options like nổ hũ kunwin is cool. Accessibility via their app is a big plus for mobile players too!

Smart bankroll management is key with online games. I recently found 999PHL-easy verification & quick payouts are a huge plus! Considering a 999phl download for a smoother experience, but always gamble responsibly! It’s about fun, not just winning.

Interesting read! Seeing more platforms prioritize user security-like the multi-layered approach mentioned-is crucial. Exploring options like 789pet games, with its blockchain-inspired verification, shows a commitment to trust & transparency. Good to see!

Mỗi lần vào blog là lại lượm được vài bí kíp chơi slots hay ho. Gần đây trò ‘Pháo Hoa Slots’ lọt top BXH App Store tuần qua. Nhân tiện nhắc đến game, dạo gần đây mình đang chơi k8 casino review, slots ở đây quay căng, hiệu ứng sinh động, chơi là ghiền. Đội ngũ kỹ thuật chia sẻ: ‘Chúng tôi cập nhật thuật toán slots hàng tuần.’

Freight delivery from China is trustworthy and swift.

Our company provides flexible solutions for businesses of any scale.

We manage all shipping processes to make your operations seamless.

china to dubai shipping cost by air

With regular shipments, we secure timely dispatch of your orders.

Clients appreciate our skilled team and affordable rates.

Choosing us means assurance in every order.

В мессенджере Telegram появилась функция звёзд.

Теперь люди могут выделять важные месседжи.

Это позволяет быстро находить нужную переписку.

где купить нфт подарки за звезды

Функция удобна для ежедневного общения.

С использованием звёзд легко сохранить ключевые заметки.

Такой инструмент сохраняет нервы и делает общение быстрее.

Scratch cards are such a fun, quick thrill! It’s cool to see platforms like slot8 games making gaming so accessible on mobile – instant fun, just like a scratch-off! Easy login sounds great too. 👍

Slot games are fun, but it’s easy to get carried away! I’ve been checking out platforms like arionplay games – seems well-designed & secure, which is a big plus. Responsible gaming is key, though! 🤔

It’s fascinating how gaming regulations evolve! The Philippines’ approach with PAGCOR, and platforms like Legend Link Maya, prioritizing KYC is smart. Secure access via legend link login register builds trust – crucial for long-term sustainability in this industry!

It’s great to see platforms prioritizing secure & transparent gaming! Responsible play is key, and quick deposit options (like those at fair play login login) can help manage budgets. Enjoy the variety!